Talking Alternatives - What is Subordination?

Mark Sherwood explains Subordination And Loss Protection (By Shannon Turnbull, 24th November 2022)

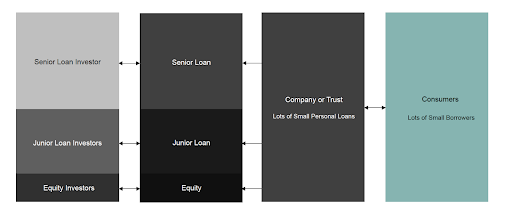

Subordination is an encompassing word that simply defines what amount of the warehouse is subordinate (ranked behind) your investment. If an investment or investment amount is subordinate to your investment, then your investment ranks more senior and in-turn typically at a lower risk.

In traditional corporate lending a senior secured loan ranks senior to a senior unsecured bond, which is senior to an unsecured bond etc.

The senior loan will rank senior to the junior loan, the key additional concept to understand is the “jargon” of subordination. The senior loan will have a percentage of subordination of the warehouse provided by any junior loan and equity relative to the total warehouse size.

As an example, if the warehouse was a total size of $100m and the junior note and the equity was $20m / 20%, the jargon would be “I have a senior loan with 20% subordination”.

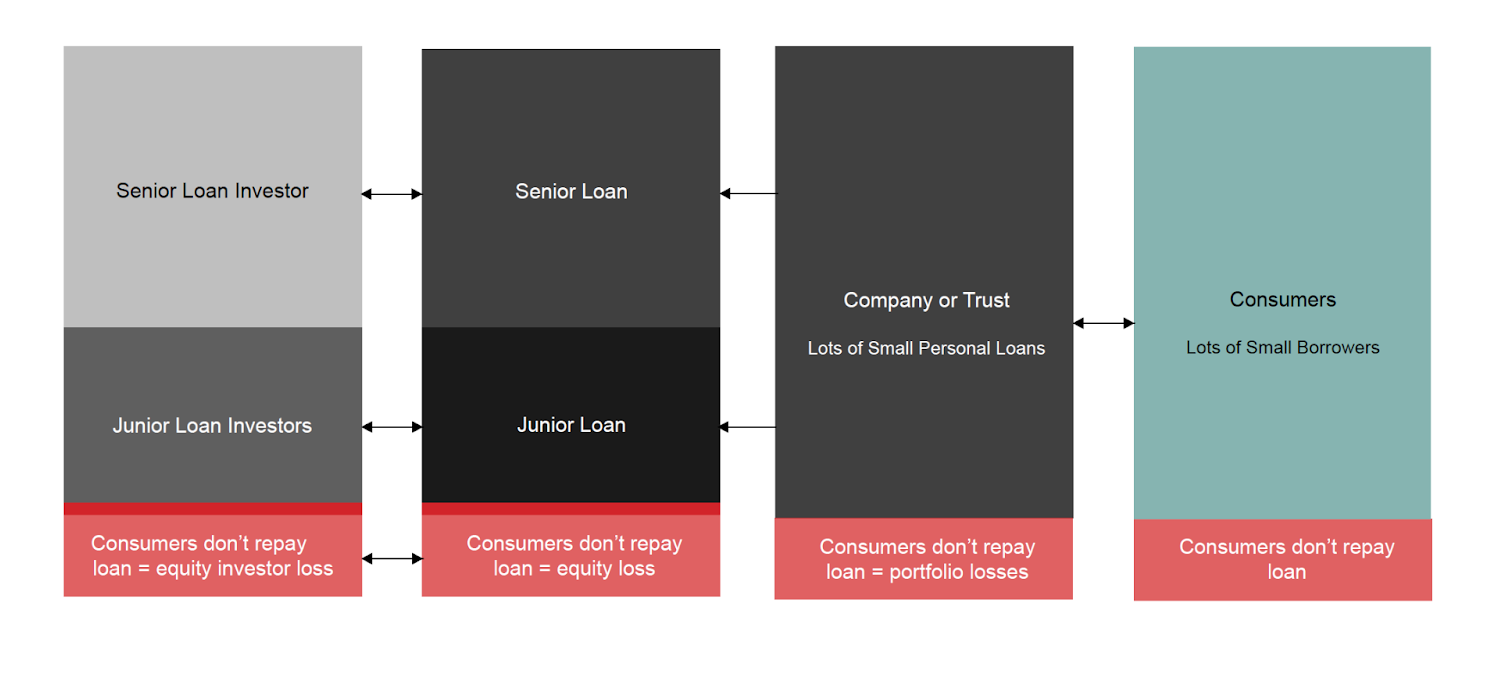

In this example, there have been a few losses highlighted by the red section. These losses flow directly back to the investors.

As the losses are greater than zero the equity investor will experience a loss, although, as the losses are not greater than the total equity investment size, it will only be a partial loss.

Both the Junior Loan investors and Senior Loan investors will not experience any losses as the loss protection/subordination provided by the equity investor has cushioned them from any losses in the example.