Why is Private Credit Good Value?

Private Credit (By Travis Miller, 15th March 2021)

As an investor asking “why?” is an important first step and this is our perspective on why we believe private credit is good value.

Value exists due to a series of structural issues including:

- bank lending constraints

- investment mandate

- fund size

- access

- complexity premium

- illiquidity premium

- educational gap

All of which drives a scarcity of capital that has the potential to be allocated to private credit and we describe these issues in more detail now.

Bank lending constraints

A key feature of credit markets since the global financial crisis has been the increased regulation on bank lending activity caused by changes to bank capital and other rules. While you might think that banks are always available to provide financing, this is far from the case and this structural situation has created opportunities for private credit investors. This structural gap takes a significant size of demand out of the market creating better priced opportunities for private credit investors.

Investment mandate

The number one objection we’ve heard is “my unrated1 bucket is full and / or I can’t invest in unrated paper and / or I need a higher return to invest in unrated paper”. All of which are valid and often set in stone in the fund mandate by the investment committee so investors understand exactly what they are buying.

What this means for private credit though, is that there is an entire audience of fixed income / credit funds that cannot buy private credit or at best can only make small allocations.

With no competition from these funds, the price just moved in investors favour.

Fund size

With compulsory superannuation there is a lot of capital sitting with very large institutions, with very large investment teams, getting paid large amounts of money.

The challenge with large funds is that small investments do not “move the needle” as the work required for a

$5m investment is often the same as a $50m investment.

This leads to a situation where large funds do not bother playing in private credit, particularly at the smaller end of the private credit market. The asset sizes are simply too small to justify the work. Large funds will often offer mandates to private credit funds through manager due diligence, rather than the asset specific deal assessment.

Less competition from large funds means a more attractive price for investors.

Access

A question often is, “even if I wanted to buy private credit, how do I actually get access?” And the answer is, it’s difficult.

The industry is quite fragmented with a few brand name listed choices. In the non-listed space, there are a few very large experienced managers focused on institutions, lots of small property based lenders with varying levels of experience and a few experienced specialist lenders, like iPartners, who co-invest across the full spectrum of credit.

While access is improving it is not yet mainstream and this reduces the amount of capital chasing private credit assets.

Complexity Premium

This one goes hand in hand to a degree with the education gap (which we discuss below). The nature of private assets are that they are complex, harder to understand and typically bespoke.

At iPartners we look to commoditise the legal structure so that investors see consistency in the investment product, legal terms and expected outcomes. While this is not a perfect solution, it goes some way to improve transparency and moderate complexity.

Complexity can reduce the amount of investors and capital looking to participate in this space. Therefore, ,from an economics perspective, this reduces the demand for more complex assets.

Illiquidity Premium

Private credit assets can be illiquid. And only certain types of investors, at a certain time of their investing lifecycle, can tolerate illiquidity. As such those prepared to invest into an illiquid asset may be able to achieve a premium as compensation for waiting to get their money back.

iPartners database of investors can create some liquidity through buying or selling units (although this cannot be relied on) that potentially offers an earlier exit if required.

Education Gap

This is the biggest gap that needs to be filled for private credit to become more mainstream. Many potential investors simply do not know what the asset class entails; how they should analyse; how they should consider the risk/return trade-off; how they should price transactions and what they should avoid.

Education is the key. At iPartners we are working to help educate investors facilitating small group sessions, sharing industry information and developing educational insights to enhance the knowledge of our investor base and the sector as a whole. We believe it is incumbent on the more informed market participants to focus on education.

This leads back to why private credit is good value.

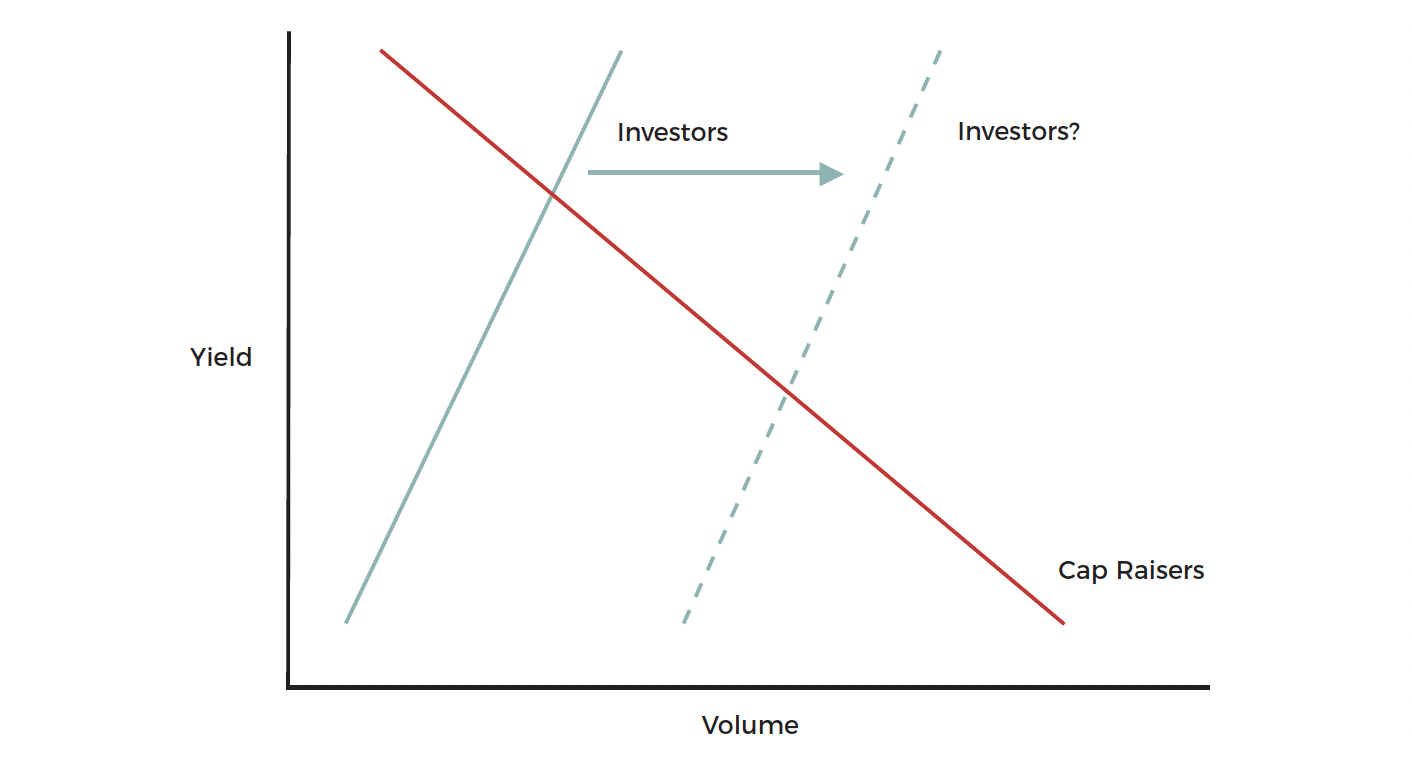

Scarcity of capital brings the discussion back to a simple supply and demand chart from economics.

The price for the asset (in credit, particular primary credit, we mean the yield) is the price where the buyers / seller match at the fair market price. In an environment of scarcity of capital (less buyers / investors) and a large volume of firms looking for capital (more sellers / capital raisers) it is logical the value sits with the savvy buyers until the structural elements above start to (if at all) normalise.

Will increased education reduce the scarcity of the capital challenge and shift the investor curve to the right in the diagram, increasing the volumes of buyers and in-turn reducing the relative value / yield in private credit?

Scarcity of Capital

In the context of the zero-interest rate environment and for the reasons identified in this article we will focus investing in private credit over public credit markets, while educating anyone who wants to listen along the way!

Notes:

1 An unrated transaction means no rating agency has assigned a credit rating to the transaction.

Disclaimer:

This document is a summary and marketing material only. This material may not be reproduced, distributed or transmitted to any other person or incorporated in any way. The information contained in this document is general information only. This document does not (and is not intended to) contain any recommendations, statements of opinion or advice. In any event, the information in this document does not consider any individual person’s objectives, financial situation or particular needs. This document is not a product disclosure statement or offer document under the Corporations Act and has been prepared for use by Wholesale Clients only. This document is not required to be and has not been lodged with ASIC under the Corporations Act. Copyright © 2021 iPartners. All rights reserved. iPartners Pty Ltd

ABN 97 616 310 555 AFSL 502 791. Level 8, 88 Phillip Street, Sydney NSW 2000, Australia.