What Is A Secured Loan Portfolio?

Secured loan portfolio is also referred to as asset backed debt or private credit. (By Shannon Turnbull, 15th September 2021)

A secured loan portfolio, also referred to as asset backed debt or private credit, is a type of secured loan which is a primary source of funding for companies looking to finance their growth or used for their daily business operations.

When investing in a secured loan portfolio it is important for an investor to understand the capital structure and the loan ranking. For example, are you investing in a senior secured loan or a junior secured loan?

Senior secured loans are the most senior part of the capital structure and are secured (or backed) by the borrowing company's assets. They are the highest priority to be repaid.

A junior secured loan, or junior debt, is issued with a lower priority for repayment than other more senior debt in the case of a default. Because of this, junior debt tends to be viewed as higher risk and thus carries a higher interest rate than senior debt from the same borrower. It is usually the second tier of debt paid immediately following the repayment of the senior debt.

Understanding the capital structure

The capital structure shows the ranking of different types of lenders according to their seniority in terms of payment and the order that creditors get paid if an issue occurs. Lenders at the top of the capital structure are the most senior and will be paid before those below them in the structure. The lower a lender ranks the greater the risk of capital loss. Senior secured loans are the highest ranking.

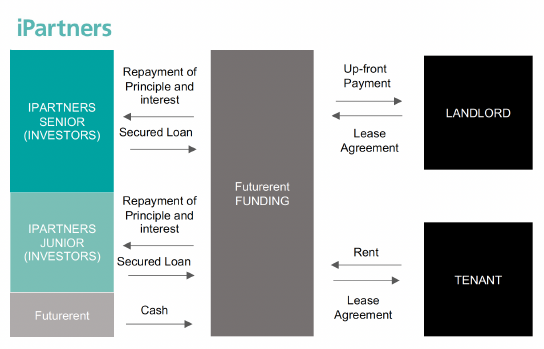

At iPartners, when originating investment opportunities, we select strong loan servicers upfront and then structure the transactions to have resilience through business cycles to ensure structural protection in our investments. Investors directly benefit from these protections which can include inbuilt subordination, retention of the business’ Net Interest Margin (NIM), first ranking secured positions and other legal protections to ensure we have maximum control of outcomes for investors.

For example, a recent investment opportunity with Futurerent consisted of two series. Senior Series 1 paying 8% p.a. with 40% first loss protection and Junior Series 1, paying 12% p.a. with 12% loss protection provided by the Servicer Equity to ensure a strong alignment of interest for iPartners investors.