What is a Funding Warehouse?

Private credit (By Travis Miller, 16th December 2020)

The best way to think of a funding warehouse is like a large, private, secured line of credit to a company or trust that they utilise to provide lots of smaller loans or receivables to customers.

The portfolio of smaller loans provided may be for a home (mortgage warehouse, RMBS), for personal loans (asset backed securities (ABS)) and / or receivables such as the amount a consumer is due to pay for the purchase of white goods, again ABS.

A warehouse is typically always secured by the underlying assets (small loans / receivables) and tends to have a revolving nature, so that when a single borrower repays their small loan, the company or trust can re-lend those funds and do a new small loan to a new borrower.

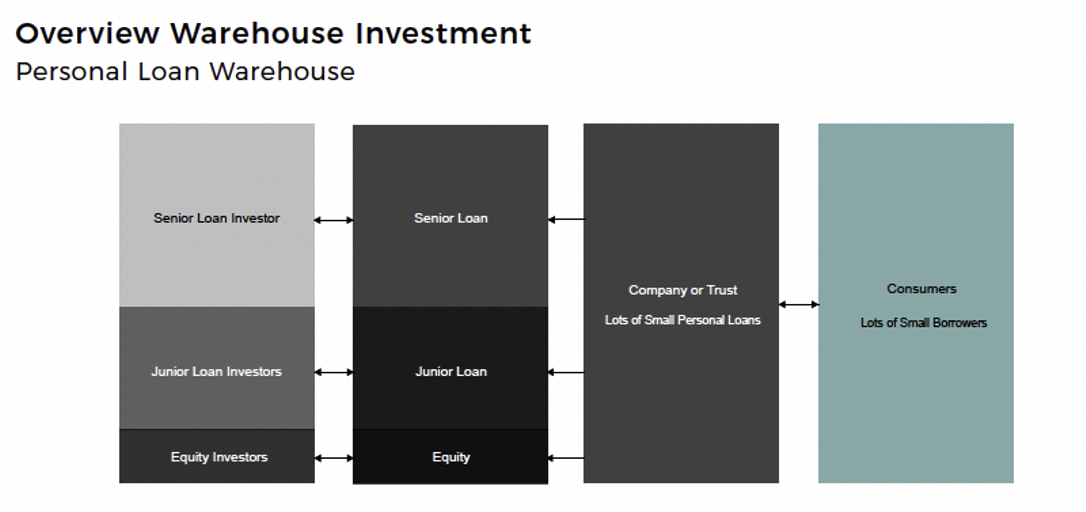

Warehouse Structure

A warehouse tends to follow a traditional securitisation approach (creating an investable product from a pool of underlying loans/receivables), with a series of investment choices available depending on the risk/ return objectives of the investor. All investors have exposure to the same warehouse and security, although through a concept of loss protection / subordination (someone takes a loss before you) investors can choose their risk profile.

- The Company or Trust is a company that lends money to consumers / borrowers for purposes such as car loans, debt consolidation or education etc.

- There are three different types of lender to the warehouse, the equity investor, the junior lender and the senior lender.

- The equity investors take the most risk and all of the first losses if borrowers do not repay their loans and there is not enough security to recover the loan amount.

- If too many borrowers default and do not repay their loan then the junior investors are next in line to take any losses from their investment.

- Lastly, the senior investor who will only lose money if lots of consumers default on their loans and there have been significant losses across the portfolio.

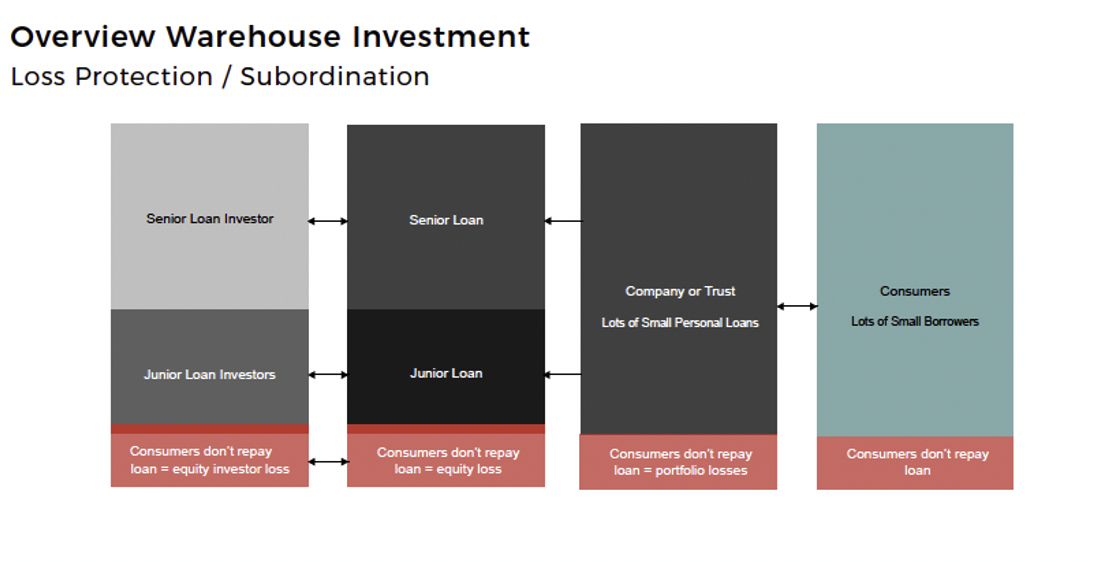

Loss Protection / Subordination

Subordination is an encompassing word that simply defines what amount of the warehouse is subordinate (ranked behind) your investment. If an investment or investment amount is subordinate to your investment, then your investment ranks more senior and in-turn typically at a lower risk.

In traditional corporate lending a senior secured loan ranks senior to a senior unsecured bond, which is senior to an unsecured bond etc.

In a warehouse it is a similar concept, the senior loan will rank senior to the junior loan, the key additional concept to understand is the “jargon” of subordination. The senior loan will have a percentage of subordination of the warehouse provided by any junior loan and equity relative to the total warehouse size.

As an example, if the warehouse was a total size of $100m and the junior note and the equity was $20m / 20%, the jargon would be “I have a senior loan with 20% subordination”.

- In the previous example there have been a few losses highlighted by the pink section. These losses flow directly back to the investors.

- As the losses are greater than zero the equity investor will experience a loss, although, as the losses are not greater than the total equity investment size, it will only be a partial loss.

- Both the junior and senior investors will not experience any losses as the loss protection / subordination provided by the equity investor has cushioned them from any losses in the example.

Other Factors

Other factors to consider in a warehouse are:

- Net Interest Margin (NIM), which is the difference in the interest received by the Company or Trust from borrowers in the above example and what is paid to all of the investors.

- Expected recovery, which is the amount that can be recovered from borrowers in the event they are in default. In an unsecured position this could be low.

- Maturity, simply the duration of the warehouse.

- Structural protections. If the warehouse is not performing what controls are in place for the lender to step in and take action.