Understanding Risks in Private Credit Investing

Private Credit - Understanding Risks (By Travis Miller, 16th February 2021)

It’s natural for investors to focus on the return side of private credit. It’s the exciting part. However, to make an educated investment, understanding what risks are involved is important in helping to determine whether the return is commensurate or greater compensation for the risk.

Key risks in private credit investing are:

- Documentation

- Operational

- Illiquidity

- Complexity

- Fraud

- Default

- Recovery

- Refinance

Documentation

This risk is the easiest to manage. It’s important that the structuring team document all relevant clauses correctly and that a mainstream, well regarded, legal firm is used for relevant sign-offs. Unfortunately, a good quality investment can fall apart if documented badly.

Documentation risk can be higher in private credit than public credit markets as it’s bespoke and less commoditised than what exists in the bond market (senior unsecured debt) which trades through traditional over-the-counter markets.

The first step to managing this risk is to ensure you are investing with experienced private credit investors like iPartners and conduct due diligence on their internal and external structuring and legal partners.

Operational

Private credit is a fragmented industry and often administered manually through spreadsheets which, if accurate and driven by a diligent operations team with attention to detail, is probably satisfactory. This is not always the case. Administrative issues can arise as a consequence of teams being under-resourced while a revenue focus can sometimes mean less attention is paid to operations such as post deal administration.

As an investor it is important to consider the size of the team, their respective skill set, relevant experience and how manual the operations process is. It is important to consider what the organisation’s experience is in alternative assets and what technology platform they use.

iPartners is a technology business. We have built a front-to-back platform to administer all transactions.

While things can still go wrong, by automating administrative functions we significantly reduce the margin for human error and in turn operational risk.

Illiquidity

Private credit assets tend to be illiquid. This means that only certain types of investors, at a certain time of their investing lifecycle, can tolerate the investment. As such those prepared to invest in an illiquid asset need to be aware that, in all probability, they will be holding the investment until maturity.

Through our secondary trading module, iPartners investors can create some liquidity through buying or selling units (although this cannot be relied on) that potentially offers a possible solution to this risk.

Complexity

The nature of private assets is that they are complex, harder to understand, and typically bespoke. There are numerous ways to legally structure an investment with exposure to exactly the same underlying asset. A senior loan, for example, could be invested in through a unit trust, sub-participation agreement, lender of record, or lender to an interposed SPV (amongst other structures).

The challenge for investors is to work through the noise and the legal structure to understand what they are actually buying. Just because the underlying asset is a senior loan, if a legal structure is interposed to aggregate investors it could materially change the risk profile.

There is no easy answer to this one. There are no obvious signs the market is consolidating or making moves towards a standardised legal structure. So, at least in the short term, it requires investors to consider, not only the investment economics, but also the legal structure and form.

At iPartners we look to commoditise the legal structure so investors see consistency in the investment product, legal terms and expected outcomes. While this is not a perfect solution, it goes some way to improve transparency and moderate complexity.

Fraud

Fraud is a risk in every form of investing. There is no absolute answer for illegal activity, fraud can occur at the underlying asset level or at the originator / intermediary level.

iPartners follows a strict due diligence process which includes a sequence of background and reference checking. With this approach the history and the reputation of relevant parties, management, board and other associated parties can be tracked and reference checked to validate credibility. In a relatively small market like Australia it is quite rare to find a potential borrower who is not known to the principals and/or known to close associates of the principals.

Being a technology business with a consistent human “four eyes” overlay process, iPartners checks and balances exist far over and above a more traditional offline business model which significantly reduces the potential gaps for fraud to occur.

While this is one risk that is hard to hedge in an economic manner, we remain vigilant and always consider this risk as we go through our due diligence process.

Default / Underperformance / Investment Risk

This is where risk gets interesting. This is a pure investment risk and where a lot of due diligence time is applied.

Default risk is simply when the entity goes into a default under the legal terms of the agreement and legal action is undertaken to recover investment proceeds or part of the investment proceeds.

It is rare to jump to a default (fraud aside) situation in private credit. Typically you will first see a deterioration in the asset value, company performance or some other trigger prior to default. These signs indicate trouble could be coming.

Prior to investing it is important to form a view on the investment originator. How experienced they are in the specific type of investment you are considering? Are there other co-investors? How experienced are they?

One key element to consider is the underlying investment security. If something goes wrong you want to be as senior in the capital structure as you can be. In the private credit world this means a senior secured loan.

Another key consideration is the underlying assets / security. A senior secured loan is of limited value over a junior loan if the company has no assets, value to be secured or recovered upon.

For the purpose of risk, this is probably the number one way you can lose money. Investment selection is critical, and understanding in detail how the investment will perform if things go wrong is important before investing.

At iPartners we first consider what can go wrong. Then we work with the borrower to ensure legal arrangements and rights are documented in a way that we can take some control if assets underperform. And in the case of a default, we ideally have adequate security to achieve a full return of capital and interest.

This is never perfect as investments always have risk. However there are many steps that can be undertaken prior to investing to position the investment for a best case outcome.

Our second consideration, which is key to our investment philosophy, is identifying a key co-investor to work with while also making sure there is an alignment of interest with the borrower. In this way, with parties protecting their own interests, they are in turn protecting iPartners investors' interests.

Recovery

This is when an entity has entered default or technical default and likely formal action is being taken to recover investment proceeds.

Expected recovery is the amount you expect to get back from the underlying asset or security from either a sale or liquidation, this amount could be less than what was originally invested.

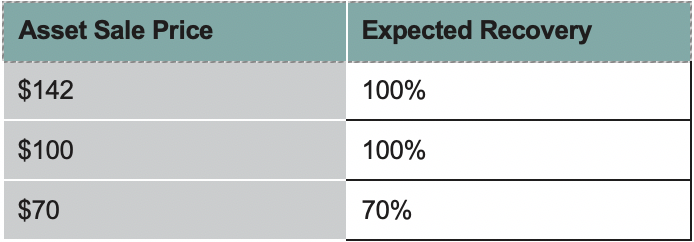

For example, if you invest $100 into a senior secured loan that has approximately $142 asset value / coverage / security it has a 70% loan to value ratio (LVR). If the entity was to default on the loan the underlying asset / assets would need to be liquidated to obtain a return of your capital.

In this example, if the entity has no other assets, investors will get a full return of their capital (possibly less after recovery costs) as long as the asset(s) can be sold for value greater than the $100 invested. If the asset is sold below value for example $70, investors would achieve a return of 70% of their capital.

Expected recovery (the inverse of loss given default “LGD”) is a relevant factor across all credit markets as public and private companies experience defaults over time.

One of iPartners key investing criteria is considering what can go wrong prior to investing. Which for the majority of our investments, leads us to invest in the senior part of the capital structure with counterparties with good security and asset coverage. This puts our investors in the most senior position if we need to recover proceeds.

Refinance

This risk is relevant in both public and private markets. It is a risk that peaks in periods of distress like the GFC and more recently during the early stages of the COVID-19 pandemic when investors withdrew from markets.

It is the risk that when your investment gets to its defined maturity date the borrower has not, or can not, repay the principal amount even though the company is roughly performing in line with expectations. This can be partly due to a mismatch in the maturity profile of the financing and the underlying assets that are the loan’s security.

In private credit, the exit at the end of an investment is often as a result of a refinance. This occurs because private debt is often used to bridge a company to a major bank refinance, for project finance, or to cover a funding gap. In the case of early to mid stage companies, it is because they often do not want to tie themselves up to long-dated expensive financing as they anticipate cheaper funding as they grow. In all these situations a new lender needs to step in for investors to receive the return of capital.

One of the primary questions investors should ask any originator they are investing with is “What is the exit?”. Uncertainty is part of investing, although you want to know what the path to exit theoretically looks like. Do they have a good track record of executing refinances? How many maturities have they given investors? And are they well networked across the market to facilitate the exit?

The last consideration relates back to our discussion on default / recovery. In the worst case, if the loan can not be refinanced and an asset sale is required, how does your position look?

iPartners co-invest with a series of non-bank lenders and we originate, structure and refinance many of our own facilities. We are well networked across the broader funding market which positions us well (but not perfectly) to facilitate refinances.

That said, the best way to achieve a refinance is to understand all potential paths to exit prior to entering into a position. No one can predict a black swan event like COVID-19, although in any scenario analysis it is pretty easy to forecast how bad things could look. If you can not think of multiple scenarios to facilitate a refinance or exit, it is an early sign to walk away from an investment.

Summary

During iPartners due diligence process, we always start our process thinking about what can go wrong.

There is no headline percentage return that can offset the time, hassle and frustration from losing money / capital.

iPartners proceed with roughly 5% of investments considered. The five primary reasons we don’t proceed with an investment are all risk driven.

- We do not know well or trust the originator/borrower (fraud / operational).

- There is a lack of experience / track record (all risks).

- The legal structure is messy or overly complex - big red flag (operational / documentation / complexity / fraud).

- There is a lack of tangible security / asset coverage (recovery / investment).

- Exit is not clearly defined (refinance).