The iPartners Investment Funds vs the iPartners Income Notes (iiNotes)

The iPartners Investment Funds vs the iPartners Income Notes (iiNotes)

Two differentiated ways to invest into diversified portfolios of private credit with iPartners (By Mark Sherwood, 9th March 2025)

Two differentiated ways to invest into diversified portfolios of private credit with iPartners: The iPartners Diversified Credit Funds vs the iPartners Income Notes (iiNotes)

Both the iPartners investment funds and the iPartners income notes provide investors with a diversified and actively-managed portfolio of private credit assets.

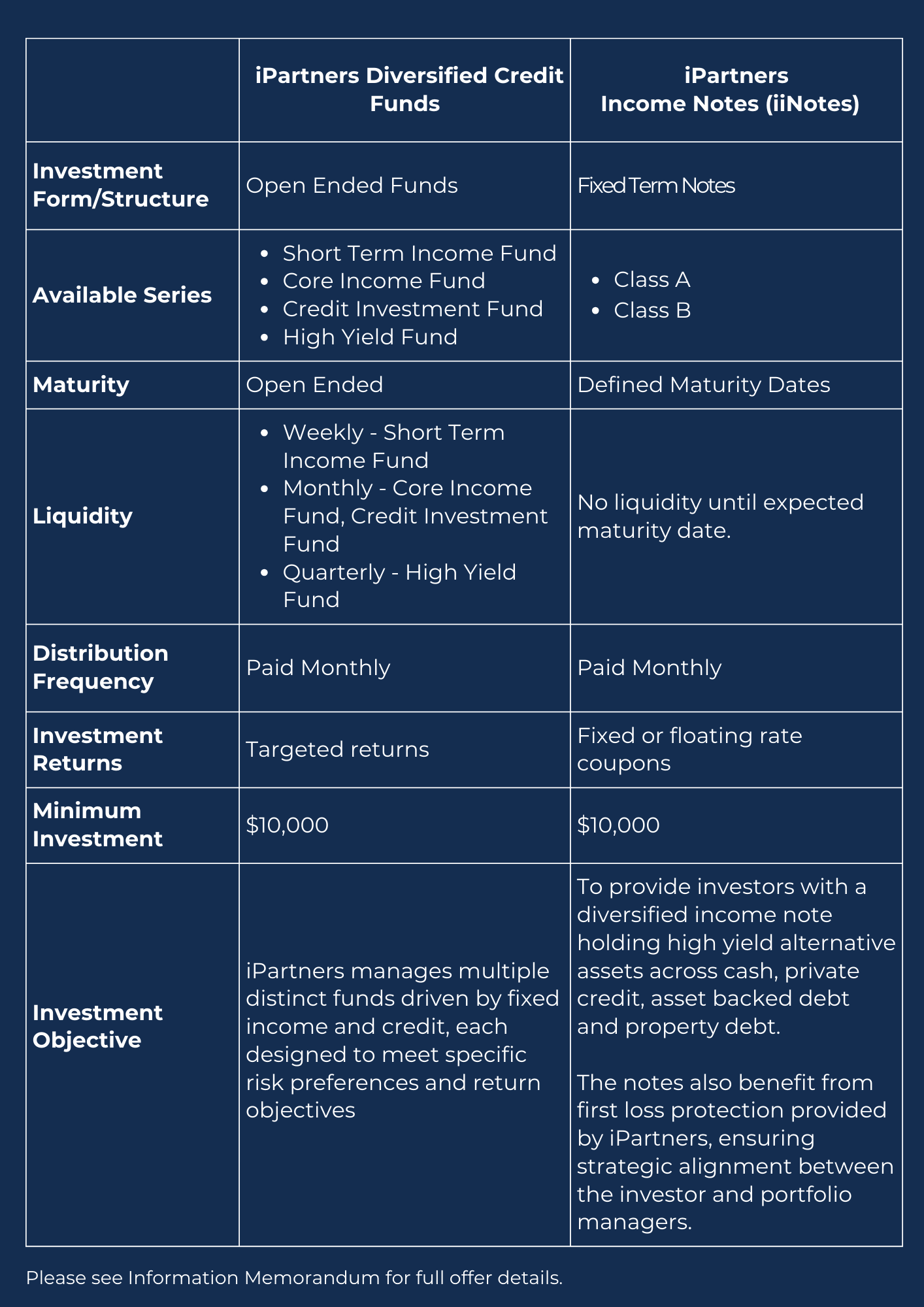

There are however differences between the two types of investments, particularly in terms of structure, liquidity and terms. The main differences are summarised below:

Summary

Both the iPartners Funds and the iPartners Income Notes, provide investors relatively stable monthly income returning investments. The iiNotes programme gives investors the ability to invest in notes that produce a fixed, declared monthly return with a fixed maturity date. Whereas, the Funds provide investors an open-ended investment, with a targeted monthly return and the benefit of monthly liquidity.