Portfolio Loss Protection

Recovery Rates (By Chris Reade, 5th February 2019)

Private securitisations are increasing in popularity primarily as a source of capital for start up financing businesses and to cater to different investor risk/return targets.

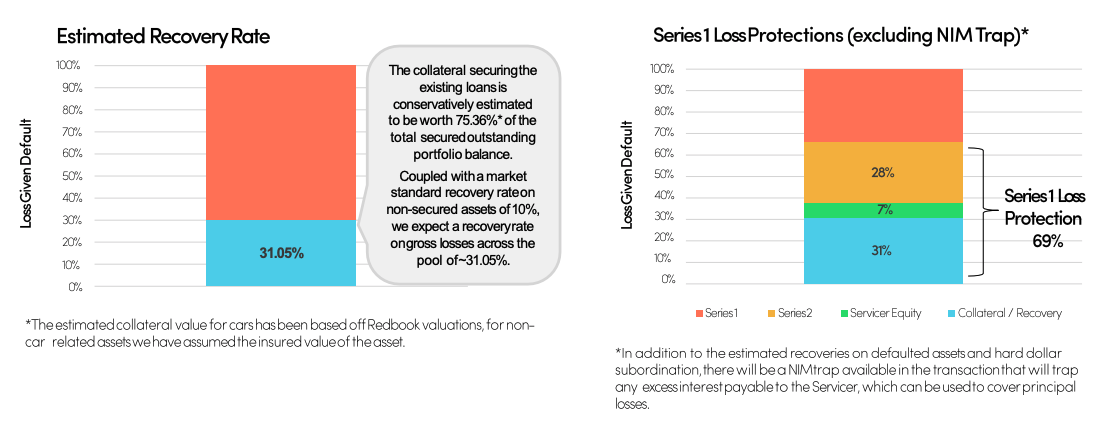

Investors typically look at the Subordination as the key measure of risk, which is a great place to start, although it can often understate the Loss Protection.

Loss Protection simply means how much of the portfolio of assets needs to go into default assuming zero recovery on all the underlying assets before the investors in the relevant tranche will experience a loss.

If we assume that the recovery given default is greater than zero then the Loss Protection is likely greater than the stated percentage.

Example - OurMoneyMarket ("OMM") Series 1 - 35% Loss Protection

The estimated recovery rate on the underlying portfolio including both secured and unsecured assets is around 31%, if this is added to the hard loss protection provide by the Servicer Equity and OMM Series 2, it could be argued that the recovery adjusted Loss Protection for Series 1 is closer to 66% of the portfolio assets. Meaning that an estimated 66% of the portfolio of assets would need to default before the 1st dollar of loss on OMM Series 1.