Leverage as a risk management tool

iPartners LEAP Series (By iPartners, 28th August 2018)

Stating the obvious, "Leverage" is typically associated with increased investment risk.

Leverage can be sourced in various forms; margin lending, instalment warrants and derivatives, all of which will increase the sensitivity of your cash in an investment to the movements in the underlying asset. Pretty basic stuff!

Then how can it be a risk management tool? As with most things the best way to explain is through an example;

Imagine you are considering a $10,000 exposure to the US Property Sector, you could choose between portfolio A & Portfolio B;

A) Buy AUD $10,000 of the US Property Sector Fund (Total Investment $10,000)

B) Buy AUD $1,000 of the iPartners LEAP Series (Leveraged Series) and buy $9000 of a Big 4 Bank Term Deposit (Total Investment $10,000)

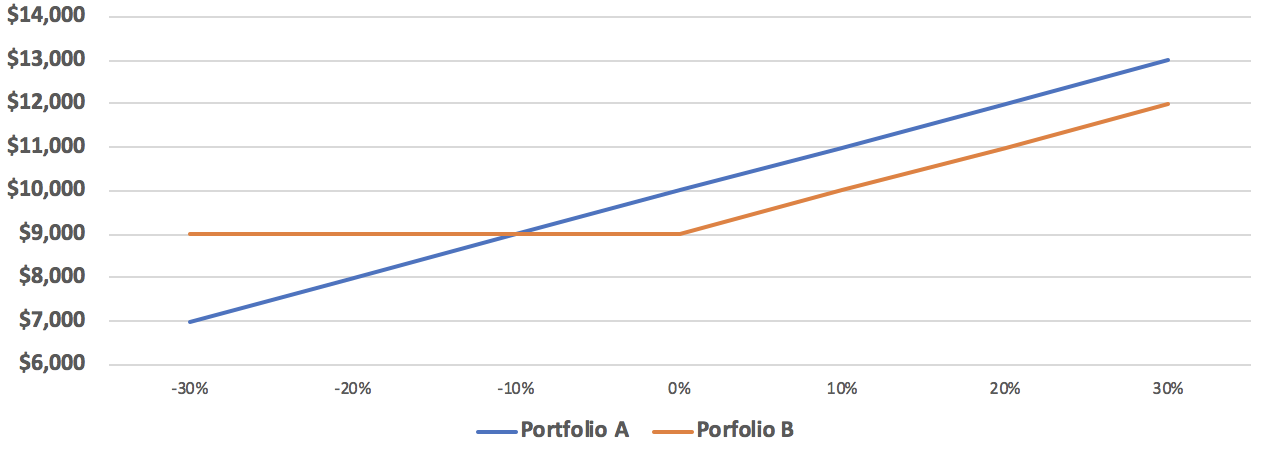

Payoff Profile Table - Investment Value (12 Months)

| US Property Fund Performance | Portfolio A | Portfolio B |

| -30% | $7,000 | $9,000 |

| -20% | $8,000 | $9,000 |

| -10% | $9,000 | $9,000 |

| 0% | $10,000 | $9,000 |

| +10% | $11,000 | $10,000 |

| +20% | $12,000 | $11,000 |

| +30% | $13,000 | $12,000 |

Payoff Profile Graph - Investment Value (12 Months)

|

In summary through utilising a leveraged investment in portfolio B we were able to;

- Protect the portfolio from loss through allocating 90% of our capital to a term deposit (government guaranteed for most).

- Increased the certainty of investment outcomes as the maximum loss on the portfolio is 10%.

- The Income from the term deposit will offset the maximum loss (In current market +2.5%)

- Retained 100% exposure to the underlying Fund

The purpose of the example is to highlight how leverage can be utilised as a risk management tool, the payoff profile demonstrates that the strategy will underperform in bullish markets, although will outperform in bearish markets and offers a more predictable set of investment outcomes, primarily as Portfolio B has less risk.

Further information on iPartners LEAP Series can be found at www.ipartners.com.au