iPartners Pullback Series 1 Comparison

Pullback vs ASX Listed Short ETF's (By Lincoln Stollery, 23rd April 2020)

In response to considerable interest, inquiry into the recent volatility spike in global equity markets, yesterday we launched the iPartners Pullback Series 1, which gives investors downside exposure to the best performing index out of the SPDR S&P/ASX 200 Index, SPDR S&P 500 Index and CSI 300 Index ETF's that track the respective broad equity market indices in Australia/United States and China.

We've received a few questions from investors with regards to leverage, specifically "How does this investment compare to other leveraged products?"

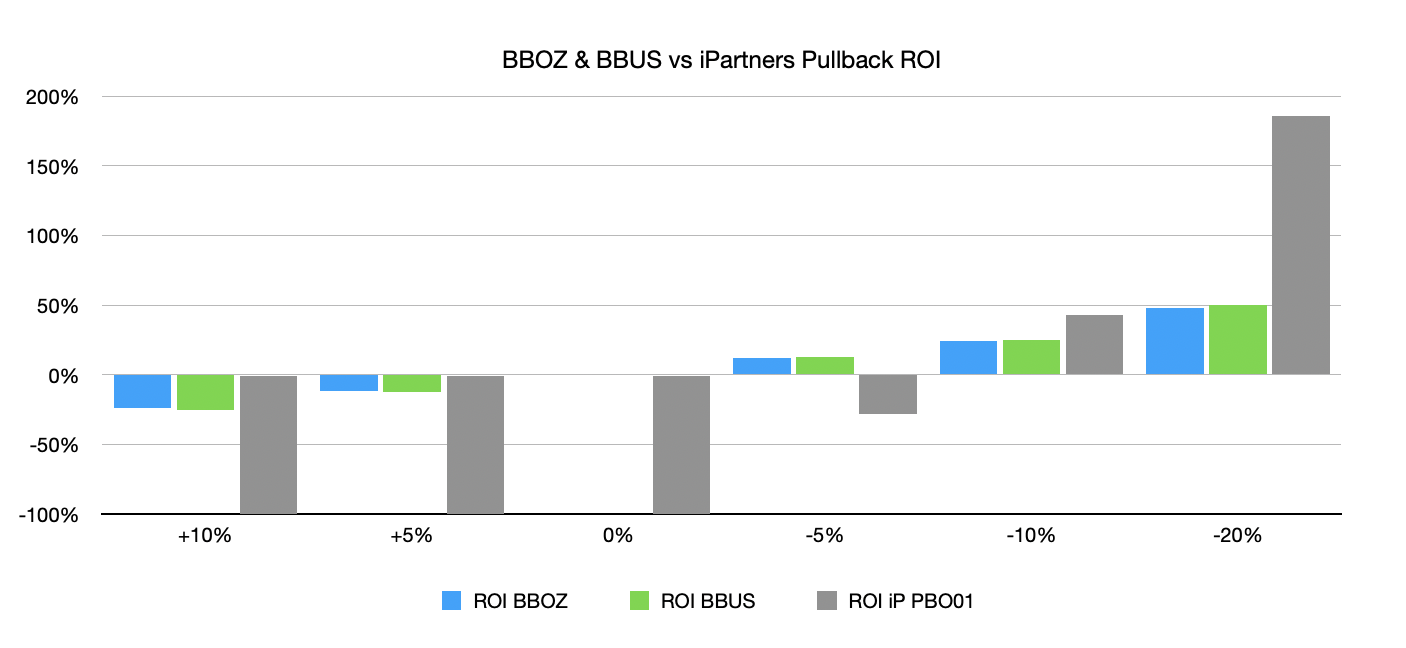

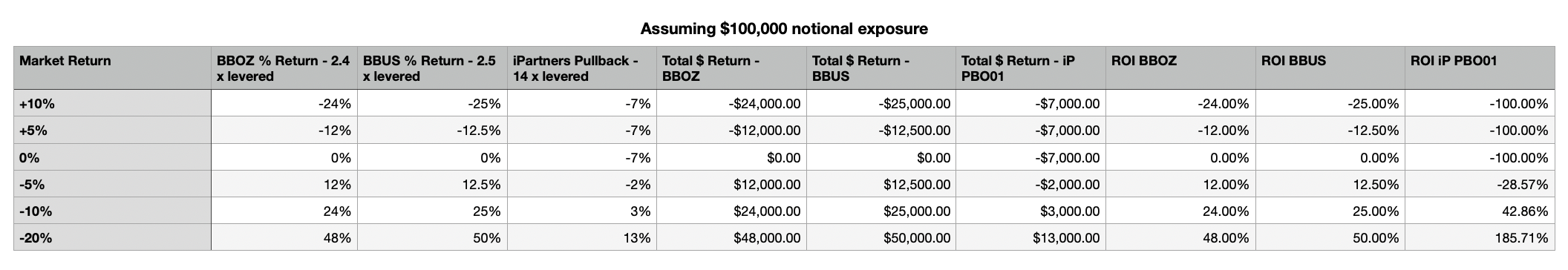

To demonstrate this we've used the ASX Listed BBOZ (Australian Equities Strong Bear Hedge Fund) and ASX Listed BBUS (U.S. Equities Strong Bear Hedge Fund) ETF's to show the return on investment payoff across all three products.

Bear in mind, these ETF products would require you to outlay A$100,000 in capital, whereas the iPartners Pullback Series provides you with A$100,000 of exposure, for a $7,000 outlay. This means that the most you can lose is A$7,000.

The comparison demonstrates that BBOZ & BBUS perform better if the reference index does not move and when the index experience's mild falls.

The iPartners Pullback Series 1 will perform better in moves up >3% (truncating the loss, as max loss is the 7% invested), or significantly outperform with any mid/larger falls on the best performing index in the reference basket.

The key assumption in above is that the best performing index out of SPDR S&P/ASX 200 Index, SPDR S&P 500 Index and CSI 300 Index ETF's is the same as the Listed ASX Short ETF used in analysis.

To invest now, please visit the deal page via the iPartners platform here.

For any questions, please speak to your iPartners representative or email service@ipartners.com.au