iPartners Funds Management – Credit Market Insights

iPartners Funds Continue To Deliver Returns On Target (By William Wong, 26th July 2022)

Volatility in financial markets continued into June with the Australian stock market delivering negative 9% for the month and fixed income funds experiencing dramatic outflows.

- One of the benefits of private markets is that they tend to be more stable in volatile times.

- The iPartners Funds had positive inflows in June and continue to deliver returns on target.

How do we see our investment sectors now and how are we positioning our portfolios?

Capital Raising Environment

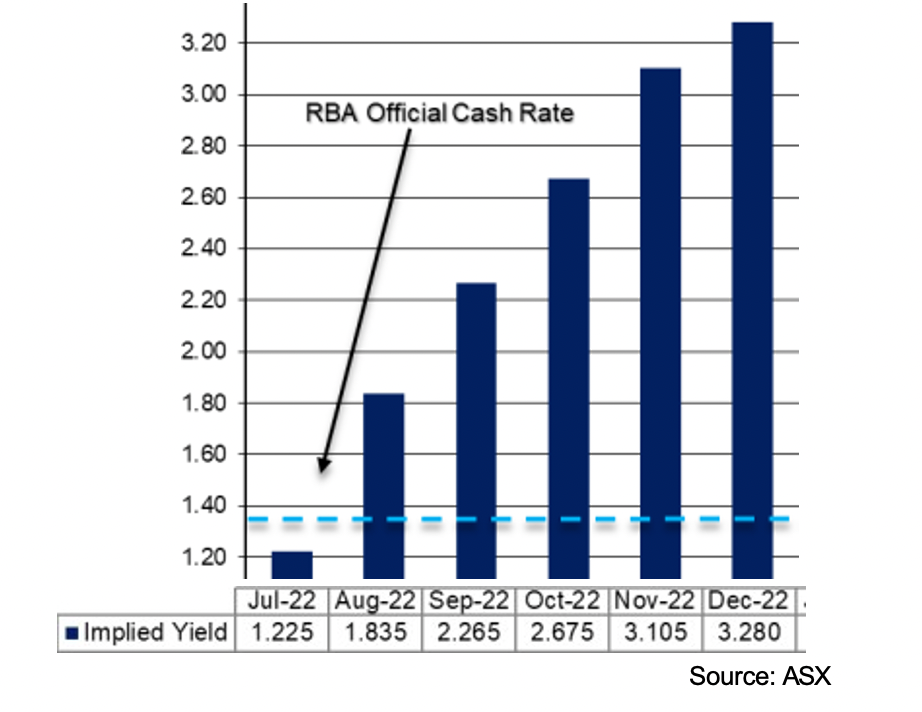

We expect inflation, interest rate rises and financial market volatility to continue for at least the next 6 months. Cash rate futures imply market expectations are for the cash rate to reach 3%, from the current 1.35%, before the end of the year.

This uncertainty and outflows from the market will lead to a tougher environment for companies seeking to raise capital, especially for those with more complex situations.

We expect to benefit from this type of environment given our strengths in assessing, structuring and executing transactions. Together with our fund inflows, this will give us:

- Greater selection of deals

- Less competitive situations

- Superior risk adjusted returns

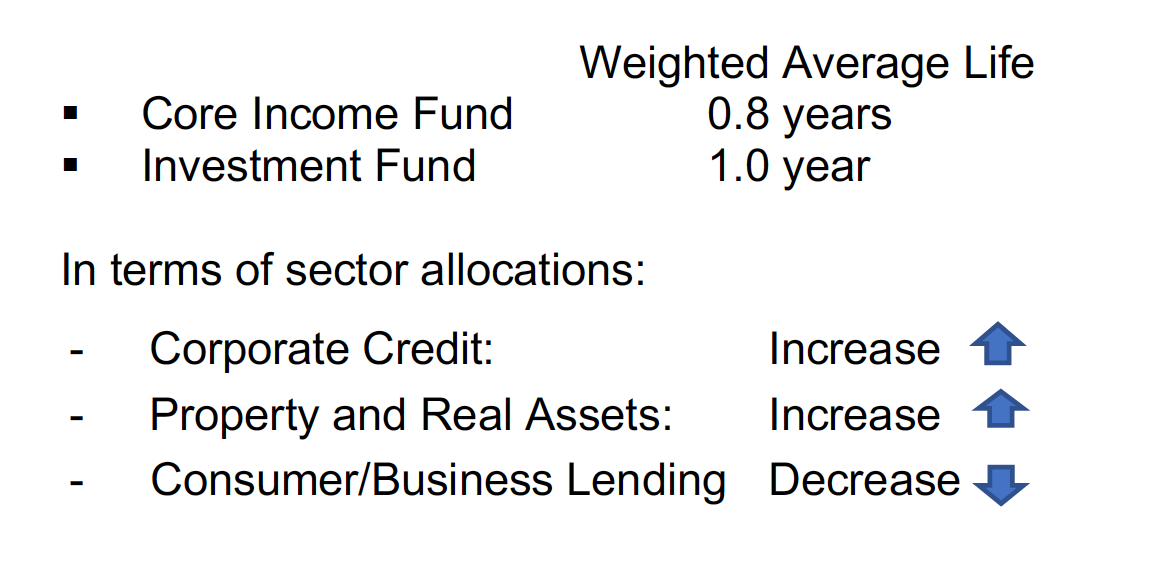

Portfolio Positioning

We will continue to maintain a conservative approach. Keeping a relatively short maturity profile and moving to mostly floating rate exposures provides strong protection from rapid changes in economic conditions.

Corporate Credit

We continue to seek exposure to loans to individual companies in the small to mid-market category. These companies have limited access to institutional grade deal expertise, typically only available from big banks that require large deal sizes and can take a long time to execute.

Our capability and access to capital will allow us to cherry pick opportunities and increase diversity in our portfolios given the wide variety of companies in the corporate credit space.

Companies that we like tend to have proven operating businesses, strong and predictable cashflows and/or assets, and unusual or complex situations where we can generate superior returns by providing an exceptional and bespoke service.

Consumer & Business Lending

Although inflation and rates have increased, these have only occurred very recently and we have not seen evidence of distress in the underlying portfolios of our consumer and business lending clients.

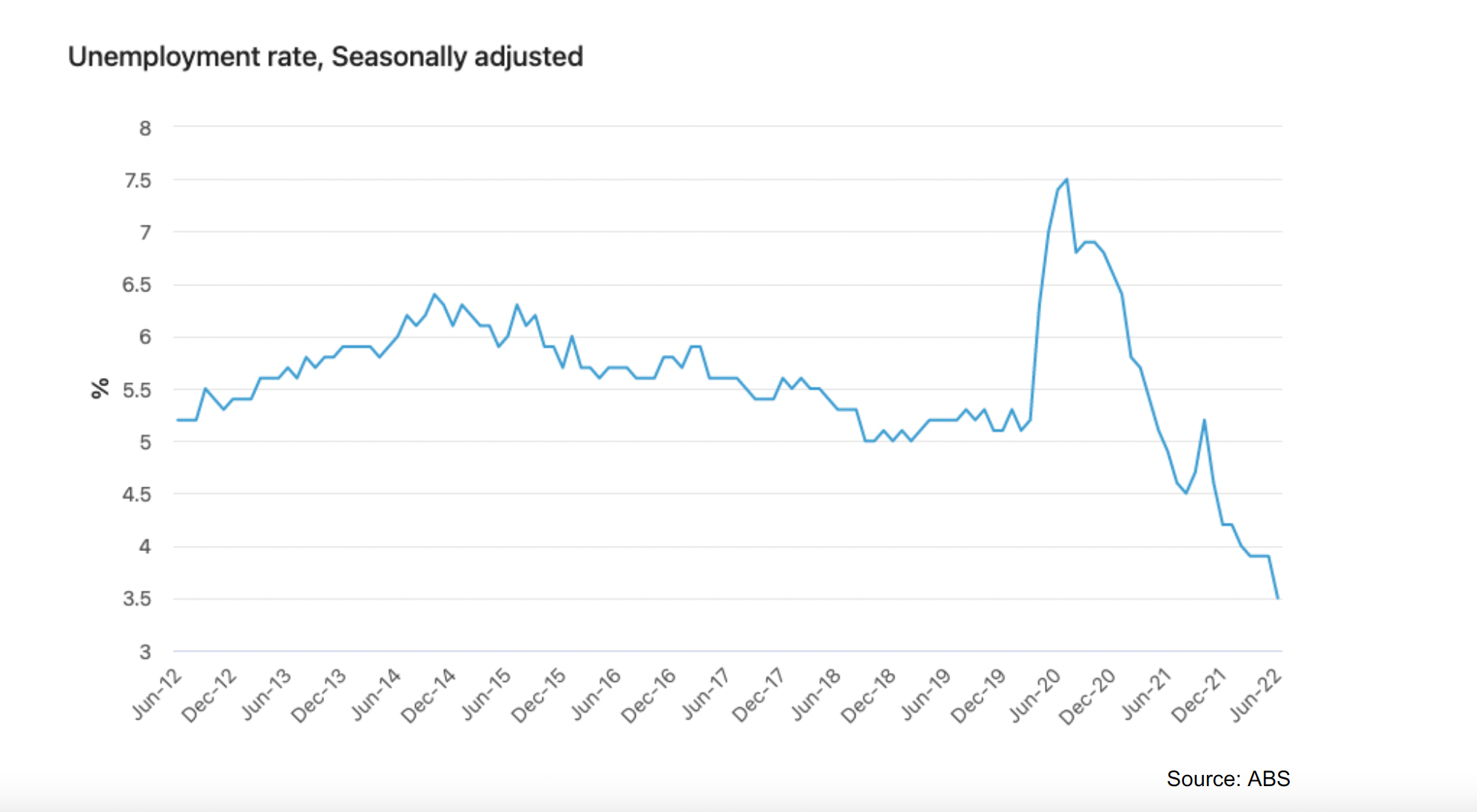

We would note that rate increases and inflation take some time to take work their way through the economy, and labour market indicators remain strong with the unemployment rate decreasing to 3.5% (chart below). Being employed is a strong mitigant to rising inflation and rates.

Whilst the business lending sector as a whole may see some impact over time from customers affected by inflation and rising rates, there is an extremely wide range of different types of businesses in the sector and there are some that will even positively benefit.

From a portfolio management perspective, we are comfortable with the individual holdings in the portfolio and intend to increase deployment of new funds into corporate credit and property.

Case Study: Ottley Secured Notes

One of the companies in our portfolios is called Ottley Capital, an Australian finance company that provides trade finance in the agricultural industry.

Ottley is quite an unusual type of business lender. One of the unique features of the business is that the funding is secured over livestock. This means that, as a credit protection measure, in a downside scenario the livestock can be sold and the proceeds used to repay the financing.

Other notable features include:

- The value of the livestock and the security increases over the term of the funding, a real benefit in an inflationary environment, and a key credit protection.

- There are strong structural protections in place including equity first loss and covenant requirements.

- The secured assets are geographically spread across the country.

Given the special features of the transaction and the attractive yields, we see the debt holdings as suitable investments for the Funds.

Property and Real Assets

We saw the property market generally at elevated levels last year and have been running very underweight property. Currently, property exposure in our funds is <10%, with minimal construction or development exposure.

This underweighting places the funds in a strong position if the market turns down, loan to value ratios reduce and margins increase, being able to increase property exposure selectively as opportunities arise (a case study on the Sunbury land sub-division is provided below).

Although we are generally underweight, we still participate in a range of property deals to provide some diversity in the portfolios and for select deals that offer attractive investments.

We have seen delays occurring in the industry due to supply and labour constraints. These delays have created some good opportunities. For example, some recent trades invested in were due to delays in obtain valuations, requiring a short-term bridge until the construction financing could close. These deals were taken on with no construction or development risk, with construction financing lined up as a take-out simply waiting for a valuation to close.

Case Study: Sunbury Land Sub-division

In the case of the Sunbury transaction, land sub- division is at the lower end of construction risk, with the majority of the loan being utilised for the land acquisition and infrastructure contribution.

The construction task is relatively straight forward and direct construction costs comprise only a minority of the use of funds.

Development risk is well mitigated with pre-sales already covering the total loan facility, and the remaining lots about to be released for sale to further reduce risk.

With the loan pricing having been set for a lower level of pre-sales, the risk adjusted return became more attractive.