iPartners - Leveraged Equity Loans

Leveraged Equity eExposure In A Controlled Solution (By Mark Sherwood, 18th October 2021)

Private investors are often seeking to capitalise on upside opportunities across equity markets almost irrespective of where we are in the economic cycle. However, can be conscious that taking a broad-based market type of exposure from here is unlikely to provide the returns they may have achieved in the last twelve or eighteen months.

Investors are therefore seeking more targeted exposures in single stock or even across specific sectors that are well positioned to provide robust and consistent earnings, particularly as yield curves start to steepen and the economic re-openings provide a staggered recovery.

Equity markets broadly are expected to see reasonably high levels of volatility at least through till the end of this year and perhaps well into 2022, in line with the volatility we have seen throughout September and October. Investors are still seeking those upside opportunities in this more volatile environment, but they are reassessing the sizing of their capital allocations to the new exposures.

Subsequently being able to take an equity position sizing that can still be meaningful to the investor in terms of potential investment upside should things move in their favour, but without having to allocate large or uncomfortable volumes of capital towards the exposure has become highly relevant.

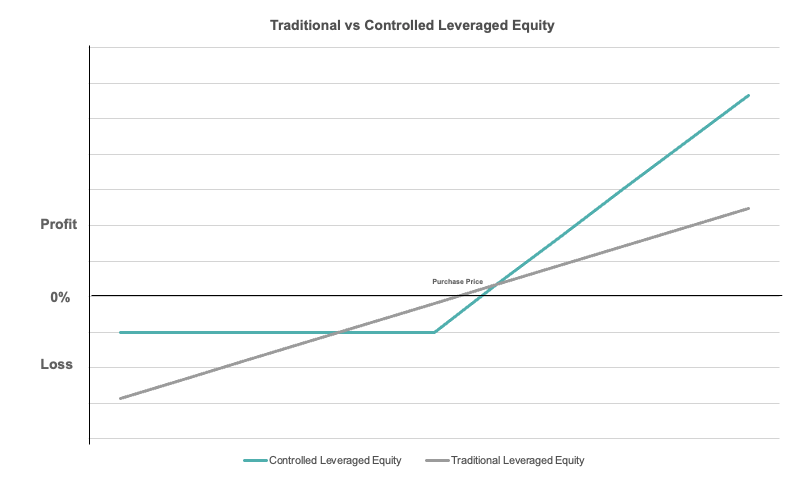

In this environment where everyone knows borrowing costs have never been cheaper, the use of leverage can be considered for those targeted equity exposures but must be done in a controlled manner where any potential downside has strict limits in order to avoid any unfavourable outcomes. That is, a controlled leveraged position provides the opportunity to allocate lower upfront capital to achieve a meaningful sized position where the upside is worth the investors time and consideration, and the downside case scenario is well known and understood.

The iPartners limited recourse equity loan facilities seek to provide solutions to investors that solve for all these considerations, whereby an investor can take advantage of historically cheap borrowing costs to gain leveraged exposure to a stock but in a controlled solution where downside risk is known and limited. This allows investors to take a sized position that is meaningful to them without having to allocate the equivalent capital.

iPartners currently have a leveraged equity loan product on the platform and the first facilities are being offered over ANZ / WBC and NAB. The banking sector, which is strongly capitalised, pays fully franked dividends that are expected to grow in the next twelve months after having rebasing through the pandemic and should also benefit from steeper yield curves.