Bonds Are Back with iPartners

iPartners Are Offering Our First Bond Basket. (By Mark Sherwood, 23rd June 2022)

Bonds Are Back with iPartners

The extent of the yield curve movement in Australia over the last couple of months can be described as nothing short of extraordinary.

It was only four months ago that our country had fairly benign expectations around rates and had a 10-year government bond yield still only close to 2%. However, with two consecutive rate rises already and the soaring inflationary reports being highly publicised, the market pricing changed very quickly.

Whilst the extent of the movement in the longer end of the yield curve has seen Australia’s 10-year government bond yield shift from 2% to above 4%, equating to roughly 200bps of shift in four months. The size of this movement has been even slightly exceeded at the 3-year part of the curve, where yields have moved from near 1.5% to 3.7%, a circa 220bp change.

Prior to these recent swift market adjustments, the past couple of years we saw yields available for wholesale corporate bonds being so low, they hardly warranted much of our consideration. We struggled to see any value in public markets from an absolute yield perspective relative to private credit over those last few years, however, at iPartners we recognise when shifts in the markets create new investment opportunities.

With the recent steepening of the curve adding higher underlying rates to corporate credit spreads, and combining with investor demand for solutions, we will be increasingly adding diversified bond exposures to the iPartners investor offering. At iPartners we identify relative value and thematics that help investors continue to build diversified pools of alternatives assets.

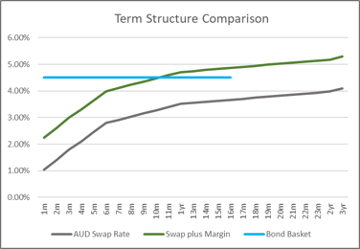

The term structure graph below shows the iPartners Bond Basket (Fixed) versus Floating margin comparison using the AUD Swap rate as the benchmark over a 16 month period.

*Source Bloomberg AUD Swap rate and S&P A- margin average

*All indicative levels as at 21/7/2022

When considering the new opportunity that has evolved in the corporate bond market, many would default their thinking towards taking exposures to rising short term rates via floating rate notes. However, a stronger risk-reward proposition can be achieved by looking at select senior fixed rate opportunities between 1 and 3-year maturities, particularly if you view the curve may have moved slightly too far too fast when pricing in the extent of rate rises over the next twelve to eighteen months. Subsequently, we are providing investors the ability to pick up the current higher yield curve available, as well as the corporate credit spread instantaneously when they lock in their fixed rate return.

Investors can also appreciate this opportunity can be taken with some diversification across credit exposures. Taking a selective parcel of corporate bonds provides diversification of credit exposures within an investor’s preferred sizing. Taking that exposure only to large Australian companies as senior creditors, has now become an opportunity for private self-directed and advised investors to achieve yield, whilst taking a low-risk credit exposure.

We view ongoing education as essential for investors in all their non-listed exposures and this includes the fixed income asset class. We look forward to continuing to help our investors make informed decisions where their risk-reward can be quantified.