Outlook in Alternatives 2022

Alternatives Asset Class 2022 Outlook (By Shannon Turnbull, 16th December 2021)

iPartners Outlook in Alternatives 2022.pdf

Alternatives Investment Outlook 2022

As we move into 2022, investors are facing significant volatility in global equity markets with the uncertainty of new Covid-19 variants and their potential implications to business models dominating headlines.

The inflationary debate has shifted to an acceptance that stimulus unwind has commenced and rates are already, or will be soon, going higher depending on the country.

There is a compelling case for an increased inclusion of alternatives in investment portfolios, as alternatives gain traction with investors who understand the need for diversification. In fact, alternatives have become increasingly prominent globally as investors look for differentiated exposures that are not directly correlated to stock market movements.

A greater level of portfolio diversification across the various sectors of the alternatives asset class, provides a means for investors to protect their portfolios from higher levels of market volatility.

With access to alternatives in Australia having improved, investors now have the luxury of not only investing in property as an alternative to their stocks and bonds but can include the full range of investments including alternative investment funds, private equity, private debt and venture capital.

Economic outlook for 2022

Alternative investments are often seen as “exotic” or “unconventional”. But in reality they operate in and respond to the same economic and market drivers as more traditional investments.

The key themes driving investment decisions in the year ahead are expected to include:

- reasonable rates of economic growth that should see the advanced economies regain pre-pandemic trends;

- persistent supply bottlenecks and rising input costs sustaining inflation and creating challenges for policy makers;

- central banks removing some of their extraordinary policy stimulus as a result; and

- risks that remain skewed to the downside.

Reasonable growth outcomes should underwrite respectable corporate metrics. The pandemic impact, however, should drive sizable variations between countries and sectors. Inflation pressures should mean higher interest rates (although still low by any longer-run comparison). Fiscal settings will be pushed and pulled by the need to wind back short-term support measures and ramp up longer-term growth drivers.

Geopolitical issues will continue to play out. It’s a recipe for market volatility.

The Australian economy

The Australian outlook closely matches the global backdrop. The pandemic drove a number of potholes into the Australian growth trajectory. But reality was less bad than feared and the forecasts are encouraging.

The economy grew by around 4½% in 2021, and the projections have a solid 5% growth in 2022.

The unemployment rate should decline further against this backdrop, the RBA expects unemployment to sit at 4% by end 2023.

The main growth drivers are the bounce back from recent lockdowns in the big states, a high vaccination rate, a reduction in household savings driving a consumption boom, a recovery in business capex and ongoing policy support.

The savings rate in Australia is near record highs. On some calculations, “excess” savings stands at around $240bn. This excess is equivalent to 17% of annual household disposable income and 22% of consumer spending. This “rainy day” money is potentially a very powerful support to the overall economy in the year ahead.

Supply chain issues are just as prevalent in Australia as elsewhere. Lockdowns meant that spending on “services” collapsed and the focus shifted to “goods”. A construction boom pushed up building materials prices. Higher food and energy prices added to the inflationary impetus from this mix of drivers. As in many other countries, goods inflation ran well ahead of services inflation as a result.

What is different about the Australian inflation experience is that the acceleration is less marked than elsewhere. And wages are not responding to tighter labour markets the way they have in other countries.

Opportunities for investors in 2022

Investor opportunities in alternatives are shaping well for an active 2022. The new year is expected to continue and even increase the pick-up in alternatives activity that was seen in 2021, particularly what was seen in the latter half-year post the Sydney and Melbourne lockdown periods.

The opportunities are shaping across a number of areas, particularly private credit issuance is likely to be supported by an expanding volume of growing financial businesses that are disrupting specific areas of traditional banking. Many of these “fintechs” are growing quickly as demand for their products from consumers drives a requirement for consistent sources of debt capital as they write ongoing and further new business. In the same fintech sectors, equity raisings are also expected to be seen in the new year to support balance sheet growth for those businesses that are moving towards institutional level and warehouse style funding.

The agricultural sector of alternatives has also been highly active in 2021 and is well positioned going into 2022. The sector is being supported by general strength seen across soft commodity, cattle and livestock prices. Farm aggregation strategies are expected to continue to drive equity opportunities across agricultural exposures.

Real estate lending with non-bank lenders is expected to continue to provide investor opportunities in 2022, following the growth in volumes written by alternate lenders and the size of their deals particularly over the last two years. This will also expand to varied and new forms of real estate, including residential communities that provide affordable long-term leasehold opportunities. Deal specific and lender selection will be critical for investors given asset price growth is expected to slow after recording strong price gains this year.

Early stage growth equity opportunities and pre-IPO capital raisings will also provide further opportunities and would be expected across a variety of sectors but expected to be dominated by the financial sector.

Growth in the alternative investment market

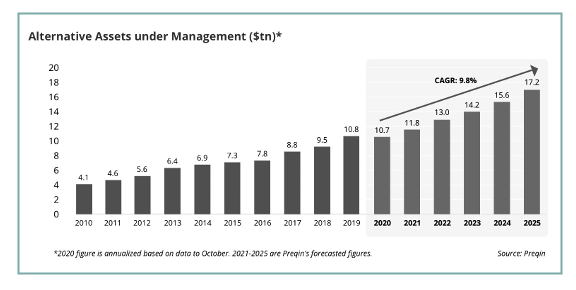

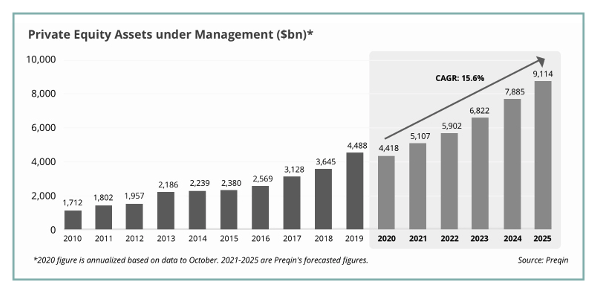

Research house Preqin expects the alternative investment market, worth US$10.8 trillion in 2019 to grow on average by 9.8% per year to 2025, when they expect the market will be worth US$17.2 trillion.

The company’s Future of Alternatives 2025 survey found 81% of investors said they expect to increase allocations to alternatives. Preqin estimates alternative assets under management to experience the fastest growth in the Asia-Pacific region with a compound average growth rate of 25.2% in the five years to 2025.

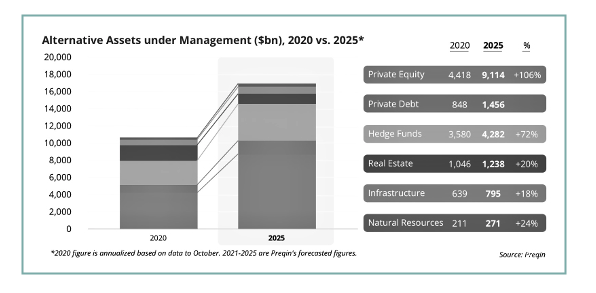

Private equity is the largest of the sub asset classes, worth US$4.42 trillion in 2020 and is expected to more than double to US$9.11 trillion in 2025. Private debt is also expected to achieve double digit compound annual growth rates and increase by 72% to US$1.46 trillion in 2025.

Alternatives in Australia

Until recently, Australian private investors have been missing out on the diversification, yield and

consistency of alternatives. The lower level of participation by private investors has commonly been reflective of their difficulties to access alternative investment opportunities. Australian SMSFs, according to ATO asset allocation tables, had just 1.4% or $8.44 billion allocated to private equity. SMSFs would likely have other small allocations to alternatives but the data doesn’t provide specific breakdowns. SMSFs are generally missing the ‘alternatives’ opportunity.

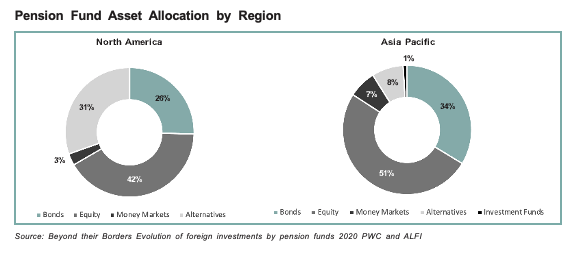

However, alternatives are playing an increasing role in pension fund portfolios globally. In 2017, alternatives made up 27% of pension fund asset allocation. Germany had the largest pension fund asset allocation to alternatives at 40.6%, while Switzerland, Canada and the UK all had allocations of over 30%.

A joint study by PWC and ALFIi, Beyond their Borders Evolution of foreign investments by pension funds

2020, found that Asia Pacific pension funds had an 8% allocation to alternatives while North American and European funds had 31% and 13% respectively.

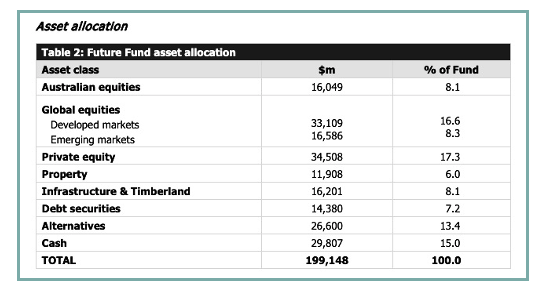

The largest Australian institutional investors however are very active in the asset class. The Future Fund, Australia’s sovereign wealth fund with over $199 billion in funds under management has exceeded its benchmark returns in the last 10 years with a 10.5% p.a. return. Like the countries listed above, it has 44.8% of its portfolio allocated to alternatives with the remainder being 33% in equities, 15% in cash and 7.2% in debt securities as at 30 September 2021.

The Fund’s allocation to alternatives exceeds Australian shares and debt securities.

Private Credit

Along with private equity, private credit is one of the fastest growing alternative assets. In the five years to 2025, Preqin estimates that assets under management will grow to US$1,456 billion at a compound average growth rate of 11.4%.

Property

Commercial real estate, known as CRE, includes retail, office, industrial, land development and tourism and leisure. The 2019 Rockefeller Global Family Office 10-year Strategic Outlook for Major Asset Classes report forecasted an annual return for the assets class of 7.4% but that was pre-Covid and the market has changed significantly since then with some clear winners and losers.

The pandemic has caused structural changes, there are less people working in offices and those returning to work need more space to social distance. High density city living and working is a lot less attractive in a pandemic.

Further, successful work from home arrangements are giving people more lifestyle choices than ever before. They can work remotely and live in smaller cities, regions or by the beach.

Offices are coming out of expensive CBD locations to city fringes for better lifestyle and cheaper rents. With borders closed to international visitors, student accommodation is much less attractive and the immediate future remains uncertain.

Covid has given a giant boost to online shopping, home entertainment, fast food and food delivered to the door. Demand for retail space has declined. Shops and restaurants have closed and retailers under financial hardship are seeking to renegotiate rental agreements. Great volumes of shipped goods need bigger logistics and greater demand for streaming services require bigger data centres. There is also a heightened awareness of the need for better aged care services and other health facilities.

It is questionable whether retail and office will recover to pre-covid levels as the time it takes to resolve the pandemic progresses increases the chance that changes become permanent. Shoppers get more comfortable shopping online and students stay at home and learn remotely.

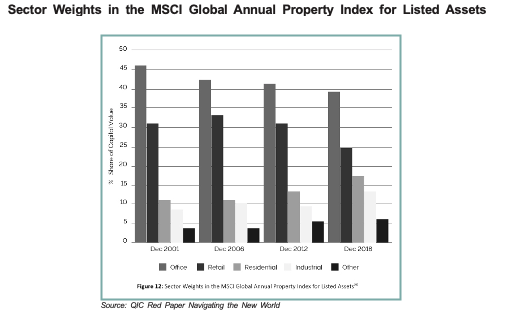

Preqin forecast real estate assets under management to grow at 3.4% per year from 2020 to 2025. In QIC’s Red Paper Navigating the New World report, pre covid figures showing percentage share of the MSCI Global Annual Property Index for listed assets showed the office and retail sectors were already declining as a share of capital value of the index before Covid.

Very low interest rates should support higher real estate prices and potential capital gain for investors but there is much uncertainty about some industries and tenant’s capacity to pay rent. The gains seen through 2020 and 2021 in residential and also through land subdivisions have exceeded most expectations.

The next couple of years would be expected to be at much lower rates of growth, likely low single digits, as buyers adjust expectations of higher rates and more stringent servicing requirements for loan applications.

Agriculture

According to the World Bank, agriculture is critical to ongoing economic growth. A 2020 report found that nearly 690 million people or 8.9% of the world’s population are hungry, up by nearly 60 million in five years. There will be an estimated 9.7 billion people on the planet by 2050.

Capital investment in Australian agriculture was up 30% in 2019 to $4.3 billion according to Australian Agribusiness State of the Industry Report (2020).

Australia’s global reputation for being clean and green means our products can command a premium when shipped overseas. However, recent Chinese trade tariff increases in key industries such as beef, viticulture, cotton and seafood have put a dampener on demand for the short term.

Still, Queensland Investment Corporation (QIC) views agriculture as an asset class that can deliver value for investors. In their paper Navigating the New World, Investment Strategies for a low-yield environment (December 2020), they estimate that production from the Australian agriculture industry will increase to AU$100 billion by 2030.

According to QIC, ‘Returns are also able to be driven by steady long-term cash flow growth, active farm management and real-asset appreciation’.

If you're interested in investing in the alternatives asset class please reach out to our iPartners team at service@ipartners.com.au